Optimizing Finance for Entrepreneurs Over 40 Through Digital Technology

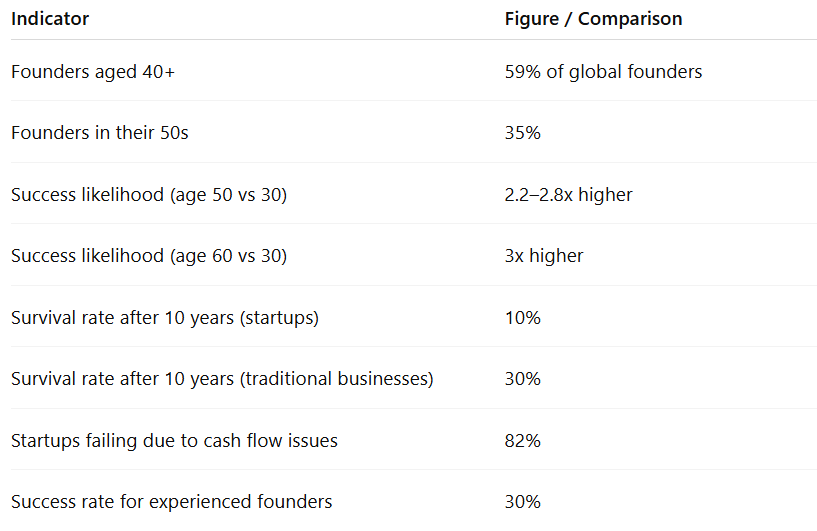

At age 40 and beyond, many people choose to embark on an entrepreneurial journey—equipped with rich life experience, diverse skills, and a deep understanding of their market. However, these strengths come with significant challenges, especially in financial management, where even small mistakes can lead to major consequences. In this context, digital transformation has become an essential tool for entrepreneurs over 40 to optimize resources, control cash flow, and make faster, more accurate decisions.

The Benefits of Digital Technology in Financial Management

Applying digital technology in finance not only automates accounting, invoicing, and reporting processes but also enables real-time monitoring of cash flow, expenses, and revenues. With just a few taps on a smartphone or computer, entrepreneurs can access their entire business financial picture—something that used to take hours or even days to compile manually.

For entrepreneurs over 40, digital transformation offers particularly clear advantages. At this age, they often balance personal, family, and business finances. Digital tools help clearly separate personal and business cash flows, reduce financial risks, and enhance capital efficiency. Furthermore, technologies such as Big Data and AI enable financial data analysis and market trend forecasting, supporting more scientific and strategic business decisions.

Beyond internal management, digital transformation also helps entrepreneurs expand markets through e-commerce, online payments, and digital marketing platforms that reach customers both domestically and internationally. This is a key advantage for entrepreneurs over 40 to stay in step with the rapidly changing business environment.

Challenges in Using Digital Technology for Financial Management

However, challenges are real. Many entrepreneurs in this age group struggle to adopt new technologies due to traditional work habits and limited digital skills. In addition, financial and human resources for digital transformation are often scarce in small or newly established businesses. Changing workflows, training staff, and building a digital-first culture require a strategic, long-term approach.

Starting a business after 40 doesn’t mean falling behind. With digital technology, entrepreneurs can turn experience into advantage, data into decisions, and finance into a foundation—step by step realizing their business dreams.

If you’re considering launching a small business—or “starting over” at 40, 45, or even 50—personal financial management is the first step to reduce pressure and move forward with confidence. Let finance no longer be a barrier, but the foundation for your next chapter.

© Copyright by KisStartup. Any reproduction, citation, or reuse must credit KisStartup.